We optimize for risk-adjusted returns

Quantitative investment strategies that aim to beat the S&P500 by systematically filtering out the noise to reduce risk and grow through bull and bear markets.*

*We cannot guarantee future performance and losses are possible

2020

Year Founded

0.5% & 20%

Fee Structure

$100K

Minimum Investment

1 Year

Lock-Up Period

2020

Year Founded

0.5% & 20%

Fee Structure

$100K

Min.Investment

We manage a private fund operating under Rule 506(c) of Regulation D, which allows us to engage in general solicitation and advertising to raise an unlimited amount of capital from accredited investors, provided we take reasonable steps to verify their accredited investor status.

Solimar Fund Goals

Elevate your wealth Reduce your worries*

An algorithmic multi-strategy equities fund that aims to be twice as profitable as passive index investing with half the risk*.

This material does not constitute an offer or the solicitation of an offer to purchase an interest in Solimar Fund, LP (the “Fund”), which such offer will only be made via a confidential private placement memorandum. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. Past and simulated performance is hypothetical and not necessarily indicative of future performance.

Solimar Fund Goals

Elevate your wealth Reduce your worries*

An algorithmic multi-strategy equities fund that aims to be twice as profitable as passive index investing with half the risk*.

This material does not constitute an offer or the solicitation of an offer to purchase an interest in Solimar Fund, LP (the “Fund”), which such offer will only be made via a confidential private placement memorandum. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. Past and simulated performance is hypothetical and not necessarily indicative of future performance.

Recent Content

Solimar Fund Updates

Solimar Fund has returned 26.6% after fees in 2025 (1/1/25-10/31/25).

The SPY returned of 16.3%

—

Solimar Fund: 81.7% since inception (10/1/23- 10/31/25) vs. SPY’s 59.5%

Solimar Fund has returned 26.6% after fees in 2025 (1/1/25-10/31/25).

The SPY returned of 16.3%

—

Solimar Fund: 81.7% since inception (10/1/23-10/31/25) vs. SPY’s 59.5%

October 2025

Solimar Fund Update

Solimar Fund returned +2.6% after fees in October, for a 2025 year-to-date return of 26.6% compared to the SPY’s 16.3% YTD. Since inception Solimar Fund generated a net return of +81.7% after fees (10/1/23-10/31/25).

September 2025

Solimar Fund Update

Solimar Fund returned 2.9% after fees in September, for a year-to-date return to 23.4%—compared to the SPY’s 13.6% YTD*. Since inception Solimar Fund generated a net return of 77.1% after fees (10/1/23-8/31/25).

August 2025

Solimar Fund Update

Solimar Fund returned -3.7% after fees in August, for a year-to-date return to 20.0%—compared to the SPY’s 10.0% YTD*. Since inception Solimar Fund generated a net return of +72.2% after fees (10/1/23-8/31/25).

July 2025

Solimar Fund Update

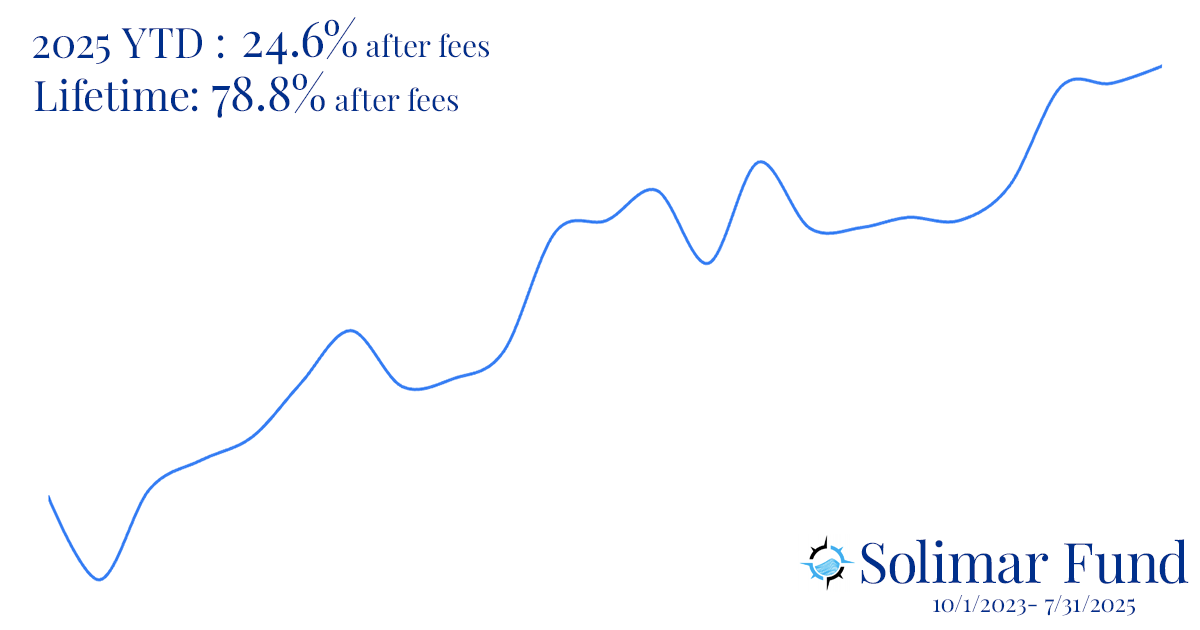

Solimar Fund returned 2.4% after fees in July, bringing our year-to-date return to 24.6%—compared to the SPY’s 7.8% YTD*. Since inception Solimar Fund generated a net return of +78.8% after fees (10/1/23-7/31/25).

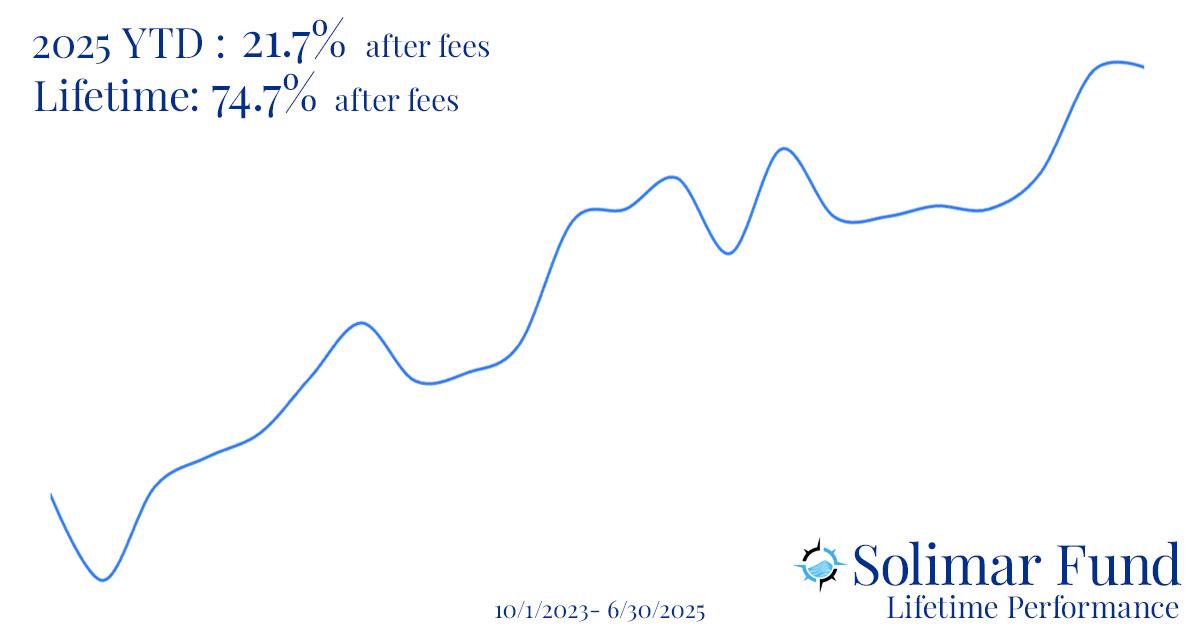

June 2025

Solimar Fund Update

Solimar Fund returned 0.4% after fees in June, bringing us to 21.7% after fees YTD, while the S&P 500 is at 5.4% YTD. Since Inception Solimar Fund is up 74.7% after fees in less than two years (10/1/23-6/30/25).

May 2025 Solimar Fund Update

Solimar had a terrific month returning 14.4% after fees in May vs. SPY’s 6.3%. The Fund now stands at 21.2% after fees YTD, vs. the SPY’s 0.5% YTD. Since Inception Solimar is up 74% after fees (10/1/23-6/30/25).

April 2025 Solimar Fund Update

Solimar Fund’s steady approach helped us navigate April’s turbulence: Solimar Fund returned 4.8% after fees, outperforming the S&P 500’s -0.9%. The Fund is now up 5.9% YTD after fees, while the SPY is down -5.4%.

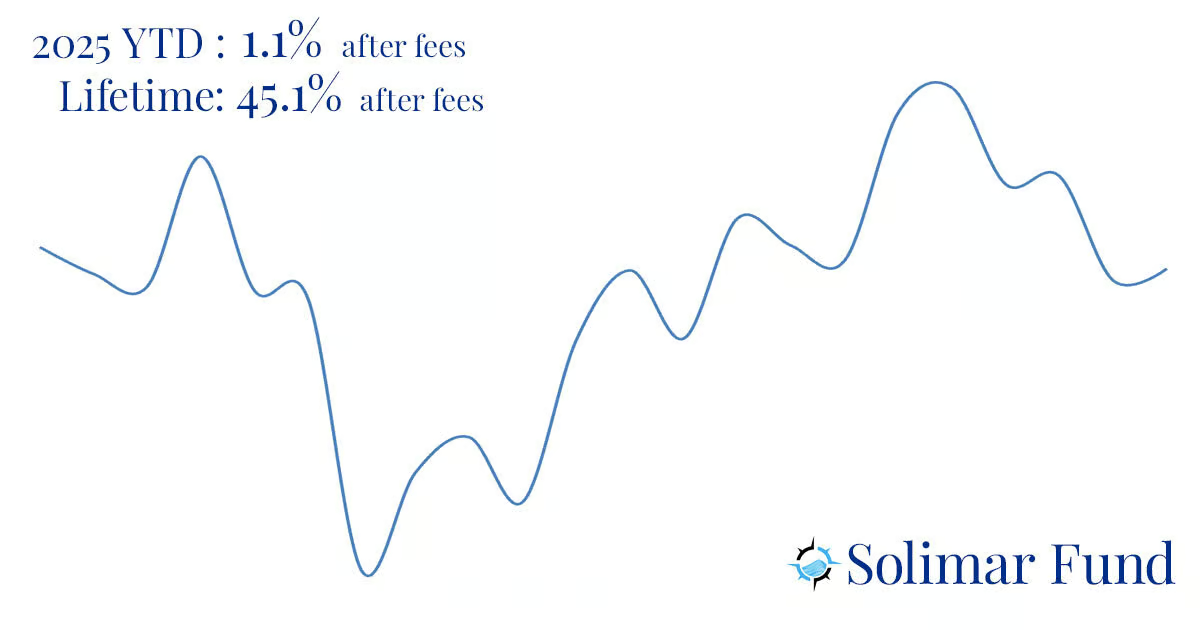

March 2025 Solimar Fund Update

Solimar Fund returned -0.4% after fees in March, outperforming the S&P 500’s -5.9%. We’re now up +1.1% YTD, while the SPY is down -4.6%. The Fund is up 45.1% since inception vs. the SPY’s 30.9%.

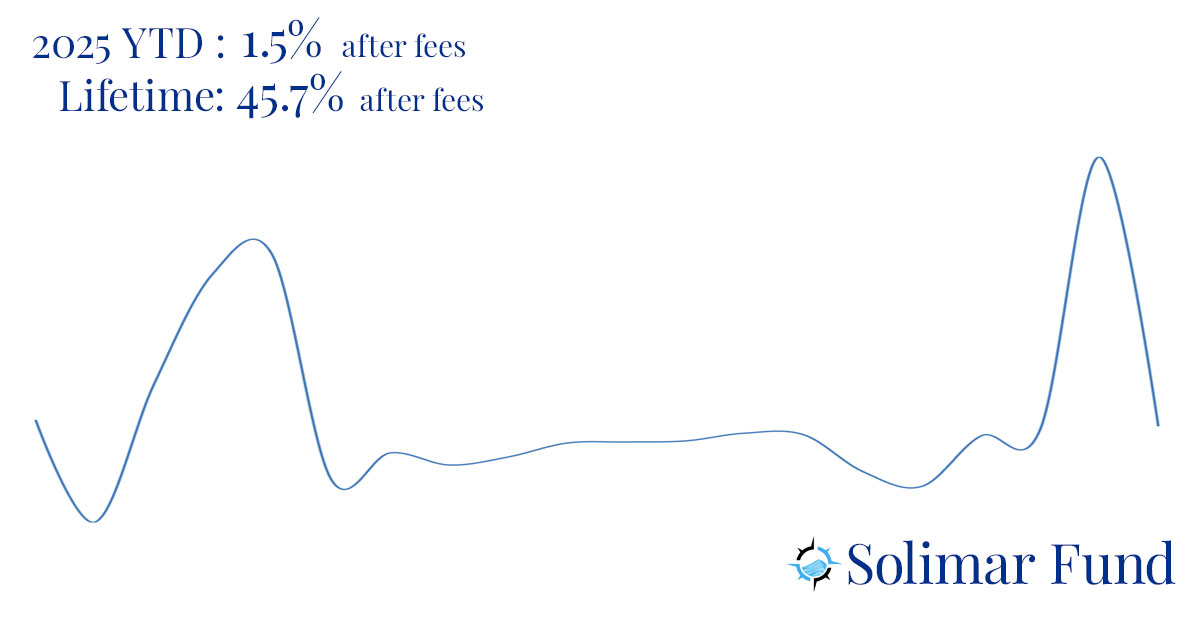

February 2025 Solimar Fund Update

Solimar Fund achieved +1.4% after fees in February 2025 compared to the S&P 500’s (SPY) -1.3%. Our lifetime returns of 45.7% vs. the SPY’s incredible 39.0% gain are both very impressive in the 17 months since 10/1/2023.

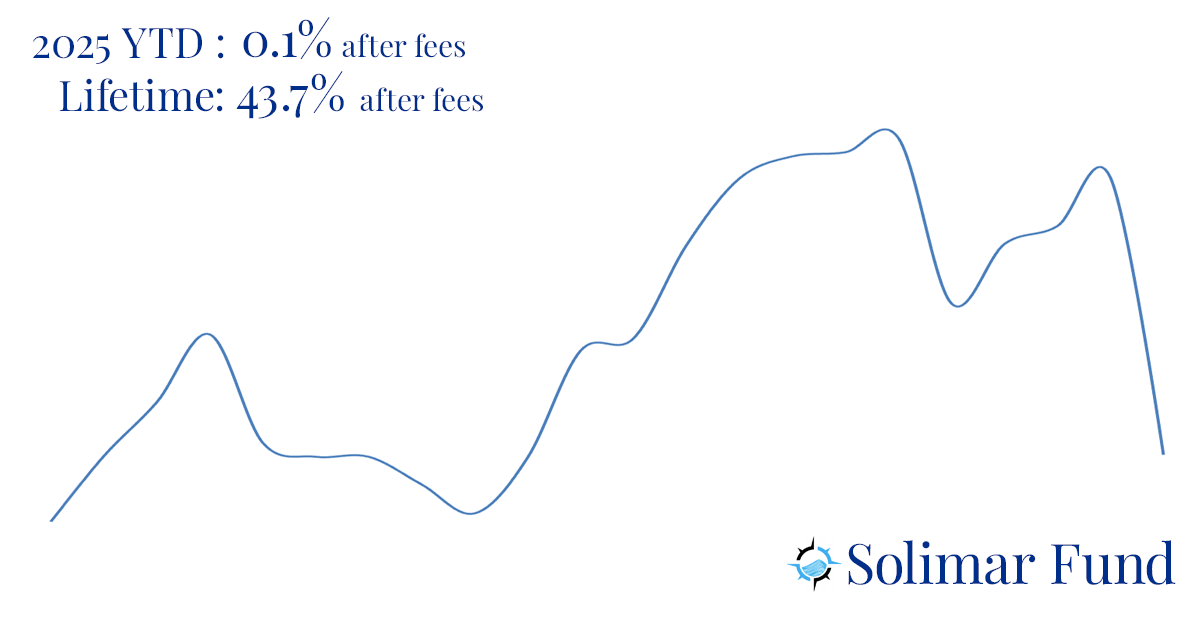

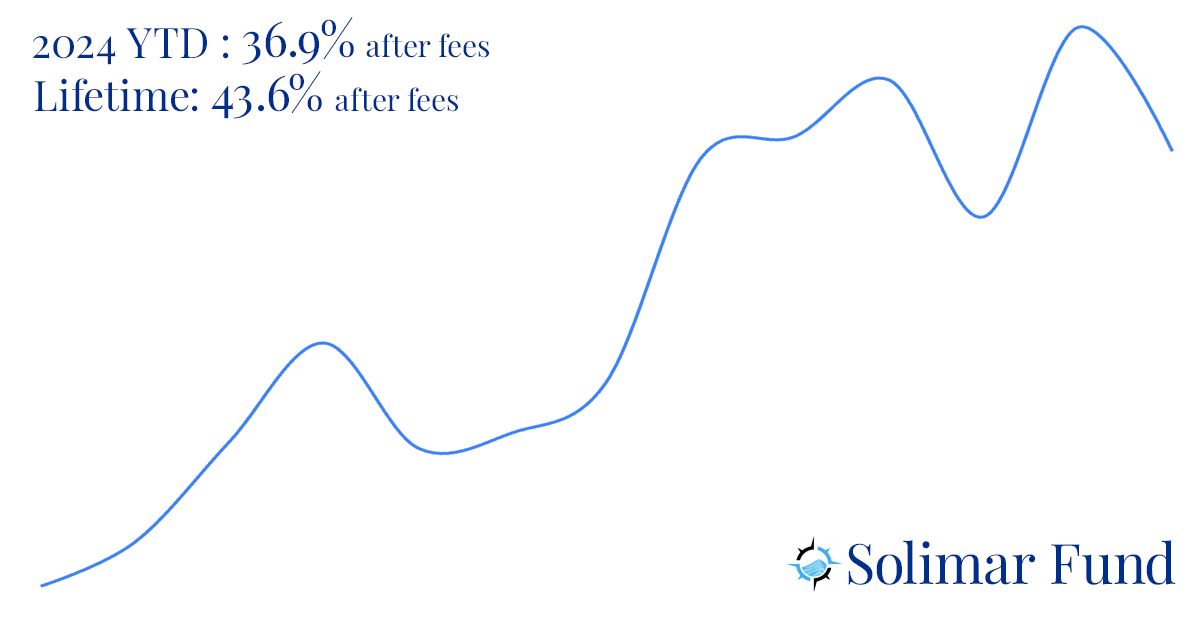

January 2025 Solimar Fund Update

Solimar Fund returned 0.1% after fees in January 2025 compared to the S&P 500’s (SPY) 2.7%. Our 2024 returns of 36.9% after fees, came close to our ambitious goal of doubling the SPY’s incredible 23.3% gain.

2024

December 2024 Solimar Fund Update

Solimar Fund returned -8.6% after fees in December compared to the S&P 500’s (SPY) -2.7%. On an annual basis, Solimar Fund returned an impressive 36.9% after fees, surpassing the SPY’s incredible 23.3% gain.

November 2024 Solimar Fund Update

Solimar Fund delivered 14.7% after fees, far outpacing the S&P 500’s (SPY) impressive 6.0% month. The Fund stands among the top hedge funds in the industry with a YTD net return of 49.6% vs. SPY’s solid 26.8% gain.

October 2024 Solimar Fund Update

Solimar Fund returned -9.4% after fees for the month of October compared to the S&P 500’s return of -0.9%. The Fund’s 2024 YTD return remains at a solid 30.5% after fees compared to S&P 500’s YTD return of 19.6%.

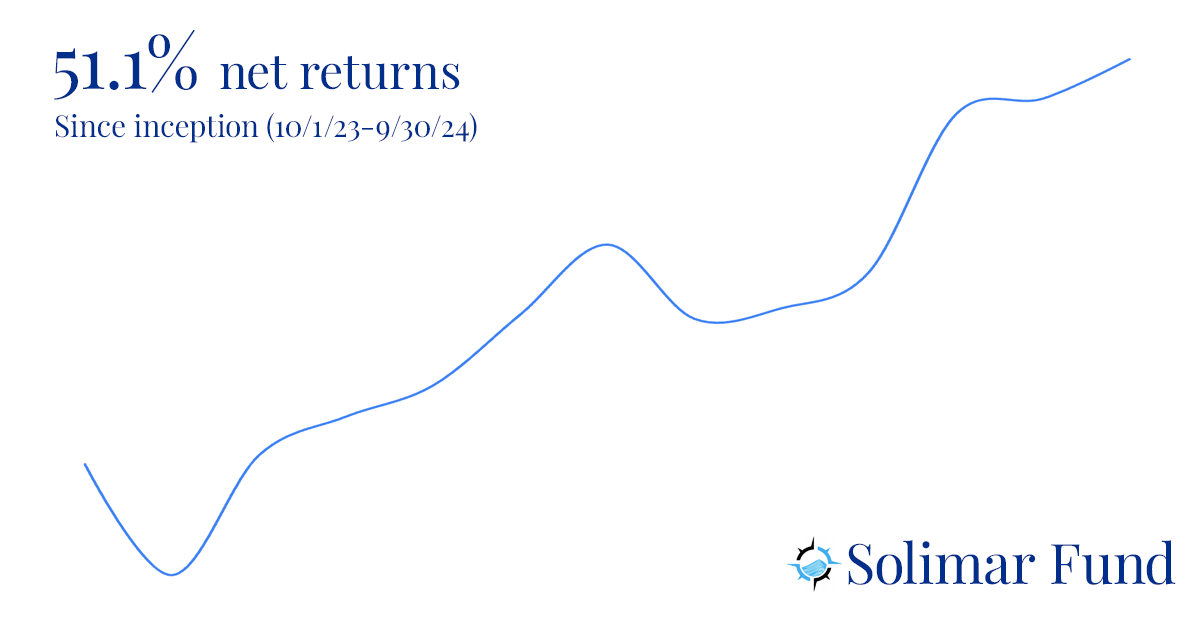

September 2024 Solimar Fund Update

What an incredible year!!! With the conclusion of September, Solimar Fund closed out its first full year of live trading with an impressive net return of 51.1% since 10/1/2023. The S&P 500 (SPY) returned 34.2% over the same period.

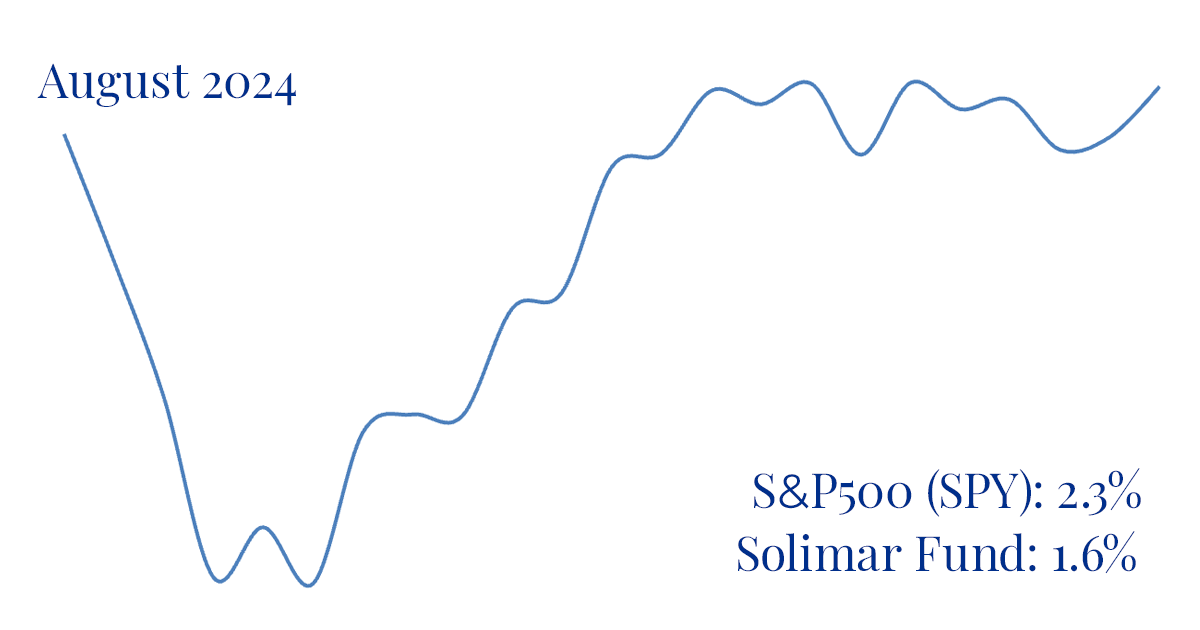

August 2024 Solimar Fund Update

Solimar Fund delivered a net of fees return of 1.6% in August. The S&P 500 (SPY) returned 2.3%. Our Fund’s net Year-to-Date return stands at an impressive 38.3%, compared to the SPY’s YTD return of 18.6%.

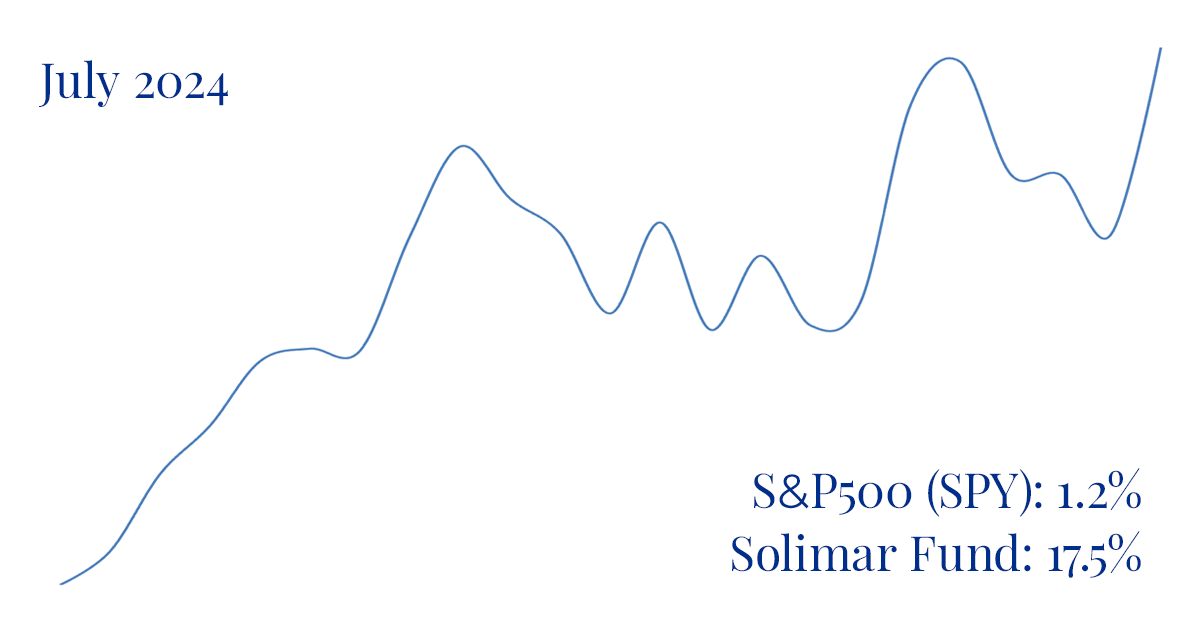

July 2024 Solimar Fund Update

Solimar Fund achieved a net return of 17.5% in July, surpassing the S&P 500 (SPY) return of 1.2%. Our net Year To Date return is an impressive 36.15%, compared to the S&P 500’s (SPY) YTD return of 15.88%.

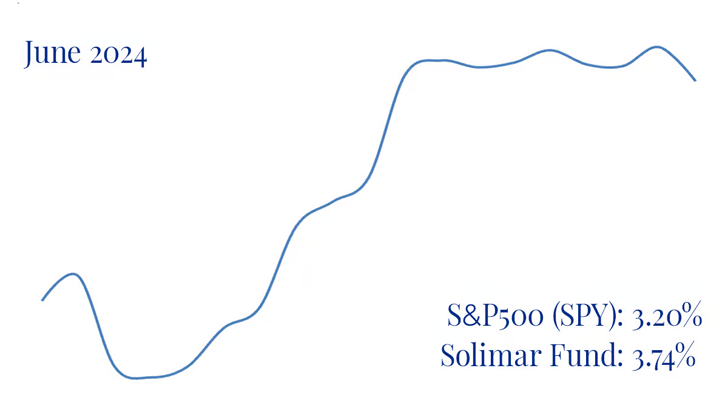

June 2024

Solimar Fund Update

Solimar Fund achieved a net return of 3.7% in June compared to the S&P 500’s (SPY) return of 3.2%. Our net Year To Date return stands strong at 15.9% compared to S&P 500’s (SPY) YTD return of 14.2%.

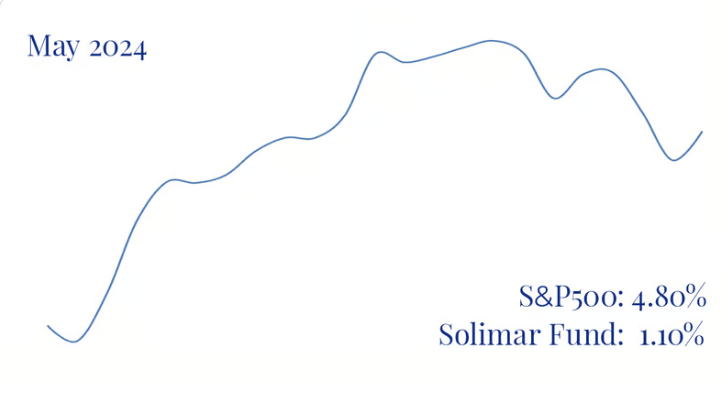

MAy 2024

Solimar Fund Update

Solimar Fund returned 1.10% net of fees for the month of May compared to the S&P 500’s return of 4.80%. Our YTD return remains strong at 11.70% net of fees compared to S&P 500’s YTD return of 10.64%.

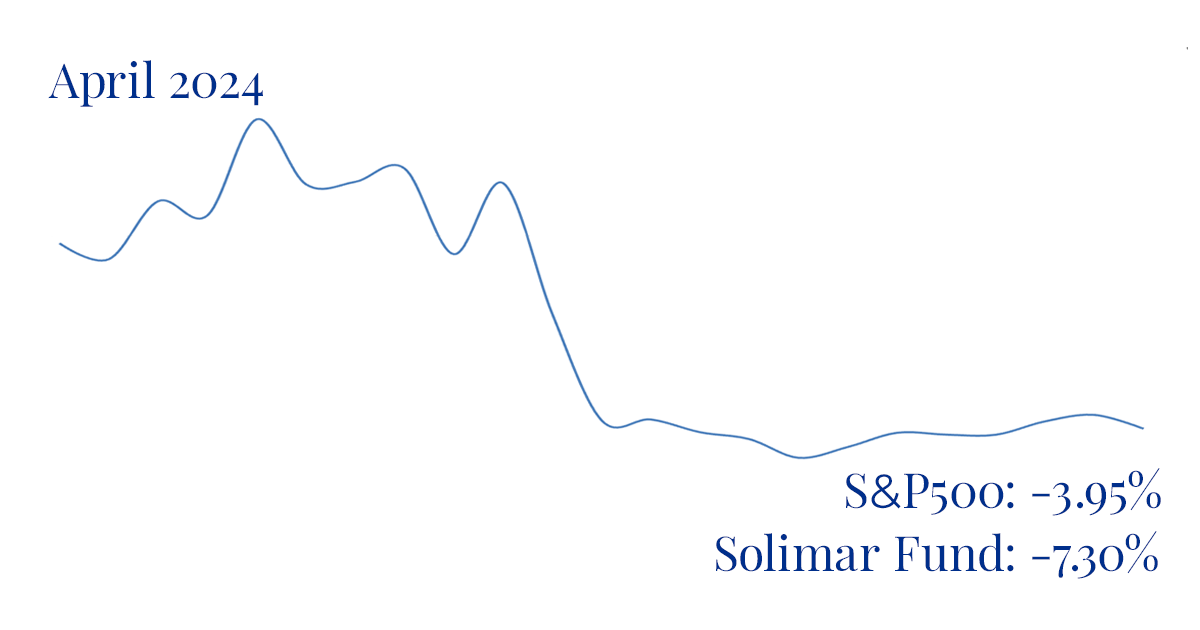

April 2024 Solimar Fund Update

Solimar Fund returned -7.30% net of fees for the month of April compared to the S&P 500’s return of -3.95%. The YTD return remains at a very solid 10.48% net of fees compared to S&P 500’s YTD return of 5.81%.

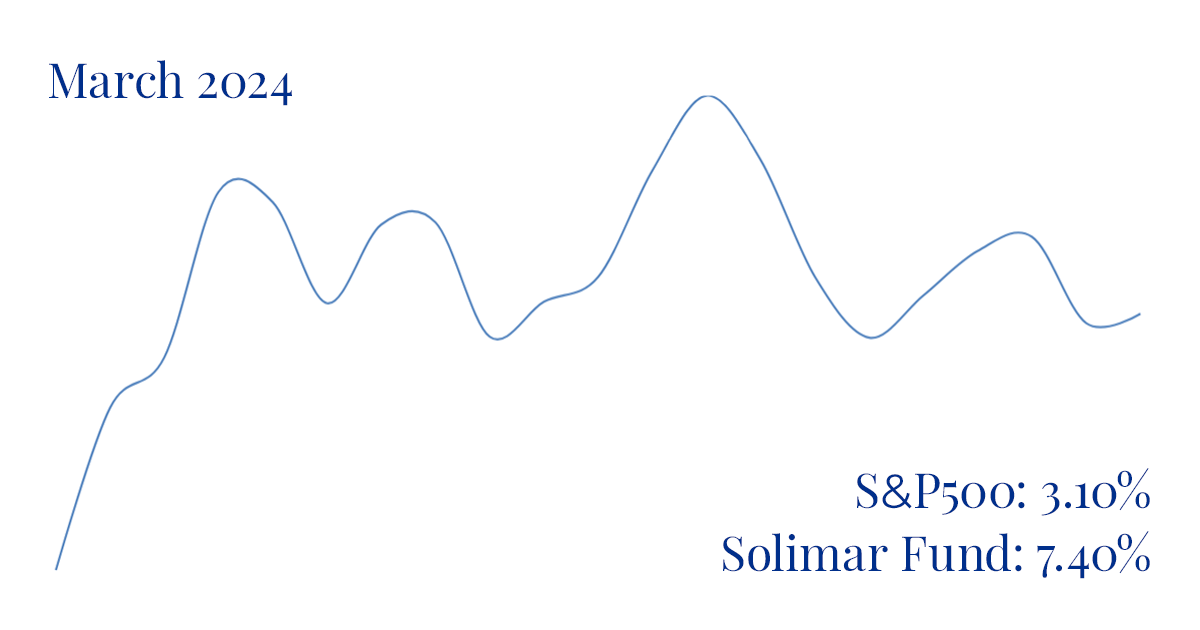

March 2024 Solimar Fund Update

March has proven to be another amazing month for Solimar Fund, delivering a solid return of 7.40% net of fees compared to the S&P 500’s return of 3.1%. First quarter returns of 19.19% net of fees vs. S&P 500’s 10.15%.

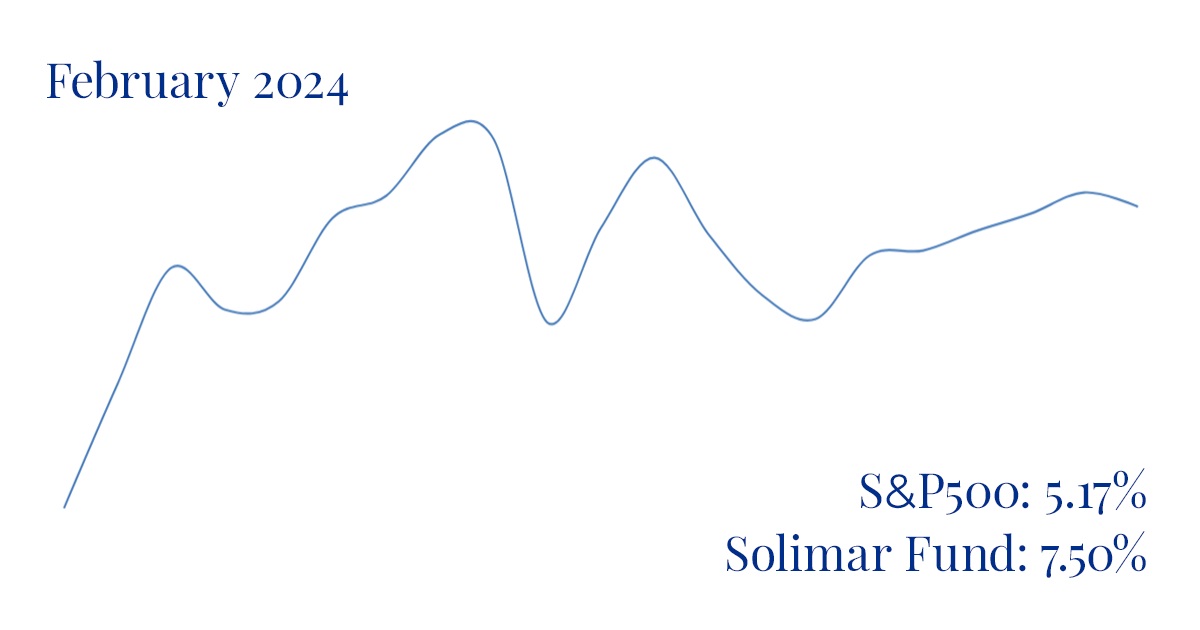

February 2024 Solimar Fund Update

February marked our fourth consecutive month of positive gains with a return of 7.50% net of fees vs. the S&P 500’s return of 5.17%. Our YTD returns are 10.97% net of fees vs the S&P 500’s YTD return of 6.84%.

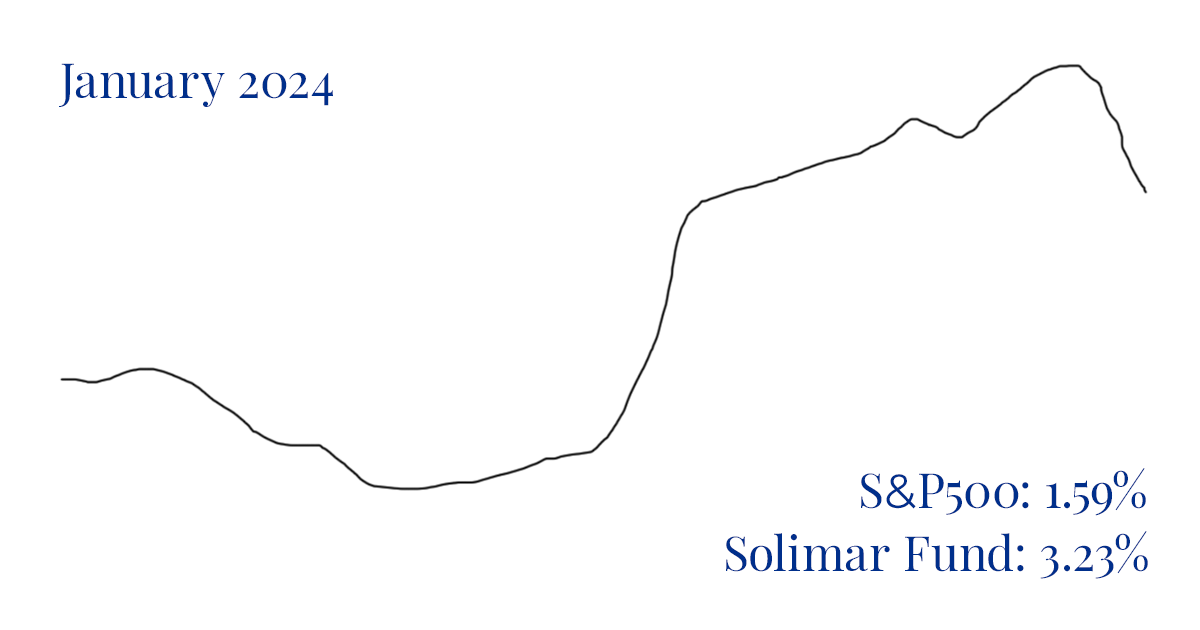

January 2024 Solimar Fund Update

We’re excited to bring you the first monthly newsletter update on the Solimar Fund’s performance, and it’s with great pleasure that we share our January 2024 returns—a robust 3.23% net of fees.