Strategies

We specialize in quantitative strategies that drive absolute returns.

Solimar Fund aspires to double your investment every three years

by aiming to double the market (SPY) returns annually

with only half the risk over a 5 year time horizon and no down years.

Solimar Fund is a private fund operating under Rule 506(c) of Regulation D, which allows us to engage in general solicitation and advertising to raise an unlimited amount of capital from accredited investors, provided we take reasonable steps to verify their accredited investor status.

Strategies

We specialize in quantitative strategies that drive absolute returns.

Solimar Fund aspires to double your investment every three years by aiming to double the market (SPY) returns annually with only half the risk over a 5 year time horizon and no down years.

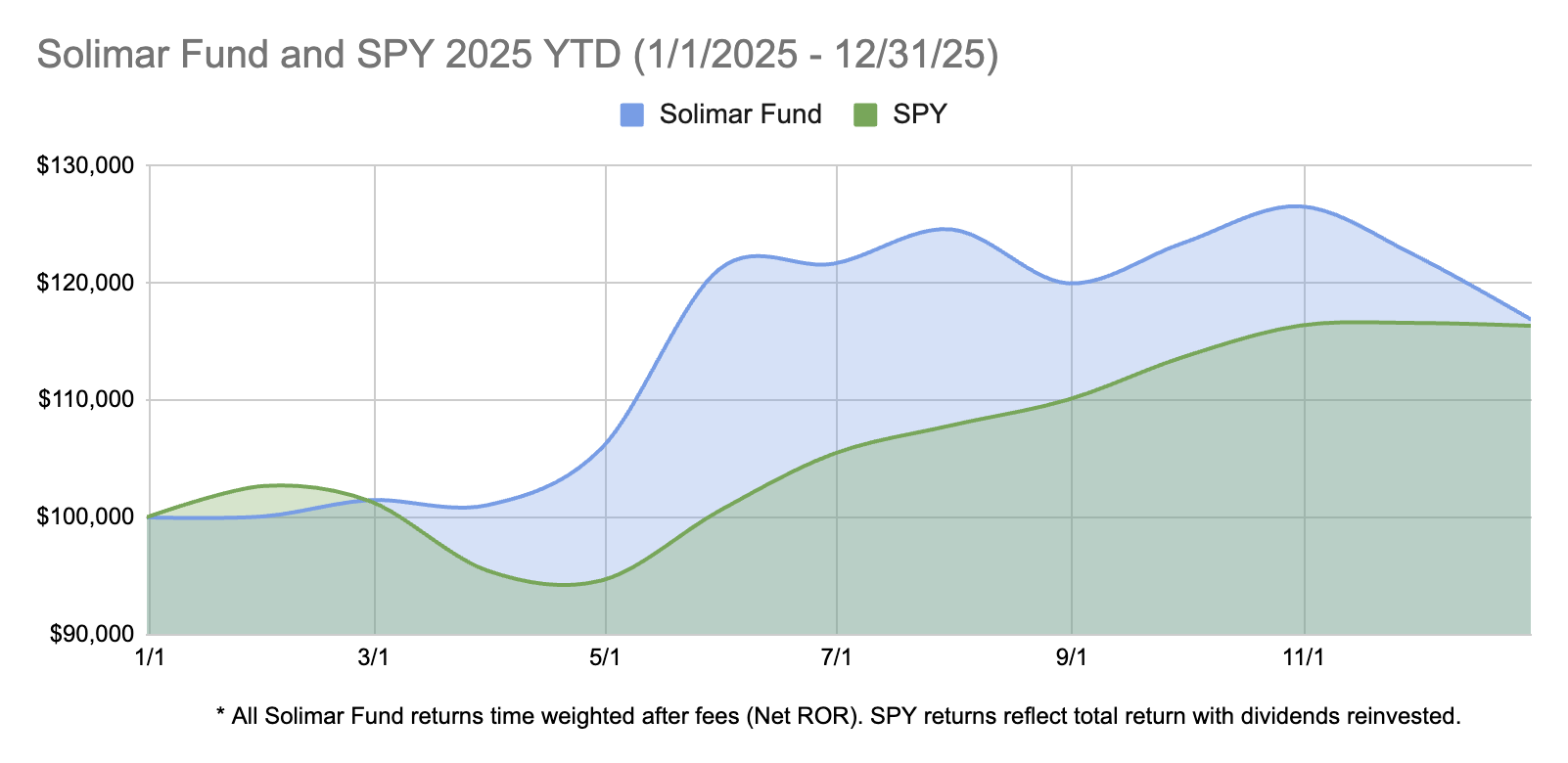

Solimar Fund Performance YTD

Solimar returned -4.5% after fees in December 2025 vs. SPY’s -0.2%. Our 2025 return is now 16.9% after fees YTD, vs. the SPY’s 16.3%. Not the way we wanted to end the year, but still green and still outperformed the SPY.

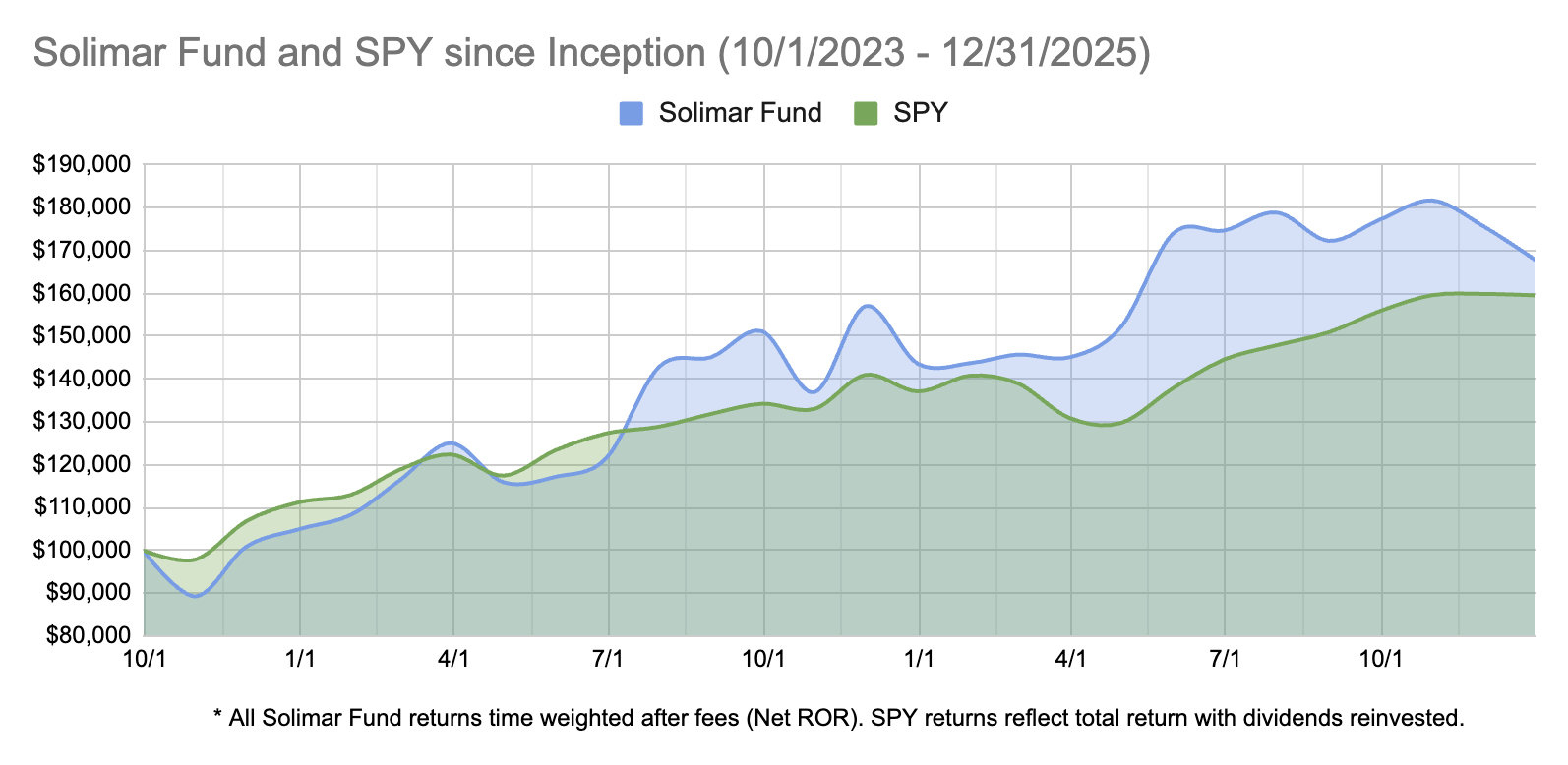

Since Inception Solimar Fund is up 67.8% after fees in just over two years (10/1/23-12/31/25).

Figures and returns represent unaudited actual returns net of fees and expenses, as reported by our third-party administrator, NAV Consulting. These figures are for illustrative purposes only and do not represent a guarantee of future performance. Returns are unaudited and reflect the fund’s actual trading results net of fees through 12/31/2025. Past performance is not indicative of future results. Investing in the Fund involves risk, including the potential loss of principal.

Figures and returns represent unaudited actual returns net of fees and expenses, as reported by our third-party administrator, NAV Consulting. These figures are for illustrative purposes only and do not represent a guarantee of future performance. Returns are unaudited and reflect the fund’s actual trading results net of fees through 12/31/2025. Past performance is not indicative of future results. Investing in the Fund involves risk, including the potential loss of principal.

Solimar Fund Lifetime Performance

Solimar Fund has had a great 27 months of live trading, returning 67.8% after fees since inception compared to SPY’s impressive 59.5% return over the same period (10/1/23 – 12/31/25).

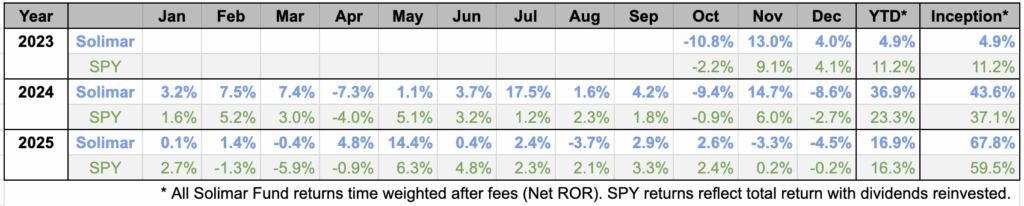

Solimar Fund Monthly Returns

All returns are net of fees (Net ROR)

Figures and returns represent unaudited actual returns net of fees and expenses, as reported by our third-party administrator, NAV Consulting. These figures are for illustrative purposes only and do not represent a guarantee of future performance. Returns are unaudited and reflect the fund’s actual trading results net of fees through 10/31/2025. Past performance is not indicative of future results. Investing in the Fund involves risk, including the potential loss of principal.

Solimar Fund returns are prepared and verified by an independent third party administrator. Contact us for more details.

Figures and returns represent unaudited actual returns net of fees and expenses, as reported by our third-party administrator, NAV Consulting. These figures are for illustrative purposes only and do not represent a guarantee of future performance. Returns are unaudited and reflect the fund’s actual trading results net of fees through 10/31/2025. Past performance is not indicative of future results. Investing in the Fund involves risk, including the potential loss of principal.

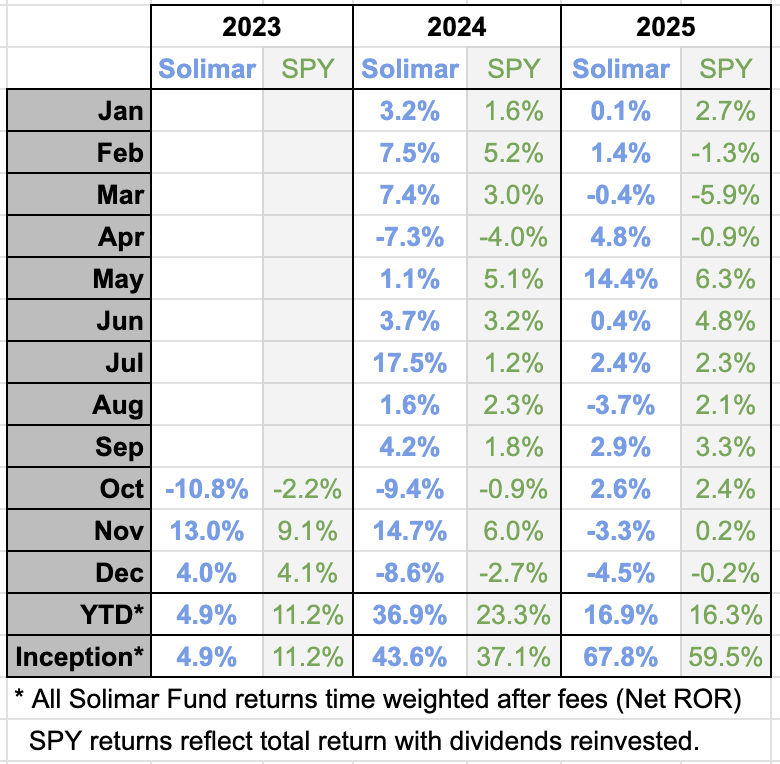

Solimar Fund Monthly Returns

All returns are net of fees